Free Form 1096 Fillable

Annual Summary and Transmittal of Information Returns

Put an digital signature in your Form 1096 aided by the guidance of Indication Software. Once the form is done, press Completed. Distribute the ready form by way of e. Free Legal Forms › Form 1096; Form 1096 Create My Document. IRS Form 1096 is a tax form used by tax-tempt organizations when they prepare their federal filings. It is better known as an Annual Summary and Transmittal of US Information Returns. Although organizations with tax-exempt status are not required to pay certain federal and state. Download Fillable Irs Form 1096 In Pdf - The Latest Version Applicable For 2019. Fill Out The Annual Summary And Transmittal Of U.s. Information Returns Online And Print It Out For Free. Irs Form 1096 Is Often Used In Irs Forms. Do not include blank or voided forms or the Form 1096 in your total. Enter the number of correctly completed forms, not the number of pages, being transmitted. For example, if you send one page of three-to-a-page Forms 1098-E with a Form 1096 and you have correctly completed two Forms 1098-E on that page, enter “2” in box 3 of Form 1096.

IRS Form 1096 is a summary tax report, which shows the totals from information returns (1099 forms) and must be submitted to the IRS along with these returns.

Form 1096 is used with all types of 1099 forms, including Form 1099-MISC, which is given to independent contractors and other non-employees to report payments. Form 1096 is only given to the IRS as a summary, not to individuals receiving 1099 forms.

Six Important Things You Need to Know about 1096 Forms for the 2018 Tax Year

1. You will need to submit a separate 1096 for every type of information return you have given to a recipient, even if you only prepared one of each kind. For example, if you prepared and submitted two 1099-MISC forms and one 1099-R form (for retirement payments), you must submit a 1096 form summarizing the 1099-MISC forms and another 1096 form summarizing the 1099-R form.

2. The deadline for submitting 1099 forms and 1096 forms has been changed for the 2018 tax year. These forms must now be filed with the IRS by January 31, 2019. There are no extensions of time permitted for the 2018 filings, even for online filings.

3. You don't have to file a Form 1096 if you e-file 1099 forms. But you may need a file a 1096 form with 1099s for state taxes. Check with your state's department of revenue or taxing authority for more information on filing 1099 forms and 1096 forms with your state.

If you are submitting 250 or more forms, you must file electronically.

4. You MUST submit the RED Scannable Form to the IRS. Don't download and print a 1096 form from the web and submit it; you could be subject to a $50 fine for submitting a 1096 form that is not scannable. You can order 1096 forms from the IRS.

5 If you file 250 or more of any one type of 1099 form, you MUST file those forms electronically. Penalties apply if you don't file electronically for these large quantities. For example, if you file 250 1099-MISC forms, those must be filed electronically. But if you file less than 250 of Form 1099-B for barter transactions, you don't need to file that one electronically.

6. The 2018 1096 forms are fillable online. That's including copies 1, B, 2, C, and D.

Tip: Be sure you have the correct year on the 1096 form. The 2018 version is used for reporting 2018 taxes. Don't use the 2019 version until 2020, when you report 2019 taxes.

When Must Form 1096 be Submitted?

Form 1096, along with most types of 1099 forms, must be submitted to the IRS no later than January 31 each year, for the previous calendar year, along with the applicable returns which it summarizes. This deadline includes 1099-MISC forms. A few 1099 forms may be filed on February 15. See the instructions to Form 1096 for a list of filing deadlines for each 1096 and 1099 form.

Aug 21, 2018 The importance of a subject like a Biochemistry in the field of medical sciences cannot be denied. The fact that there are books like Biochemistry by Jeremy M. Berg and Fundamentals of Biochemistry, there certainly is enough help out there in the library for the students. Kaplan USMLE Step 1 Lecture Notes Pdf Free Download. Contemporary Biochemistry plays a crucial role in the Medical field, be it metabolic pathways, storage diseases, mechanism action of varied biomolecules or inter and intra cellular communications. A lecture note on Medical biochemistry integrates. Medical biochemistry lecture notes.

Filing Form 1096 Electronically

The IRS allows you to e-file Form 1096, along with 1099-MISC forms and other 1099 forms. You must use the IRS's FIRE system (Filing Information Returns Electronically).

Blockbusters is a British television game show based upon an American game show of the same name in which contestants answer trivia questions to complete a path across or down a game board of hexagons. The programme premiered on 29 August 1983 on ITV and ran for ten series, ending on the ITV network on 19 May 1993. Blockbusters was revived for three additional series, the most recent of which. Game play 1980–82. Blockbusters and Las Vegas Gambit, which premiered on the same day, were added to the NBC schedule to replace The David Letterman Show. Letterman's show, for which NBC had cancelled three game shows to create a space for back in June 1980, did not draw good ratings and only managed a total of eighteen weeks of episodes (and. Blockbusters game show online.

Must I Submit Form 1096 with 1099 Forms?

If you are e-filing 1099 forms, you do not need to include 1096 forms. You must file the 1099 forms electronically, using the IRS Filing Information Returns Electronically (FIRE) system.

Where Can I Get 1096 Forms?

If you are preparing 1099 forms by yourself, you can find these forms and 1096 forms at:

- An office supply store. You may find that 1099 forms and 1096 forms are packaged separately.

- Tax preparation software. If you purchase business tax preparation software, these forms may be included.

- Your accounting or bookkeeping firm or your payroll service should be able to prepare these forms for you.

- You can order these forms online from the IRS online.

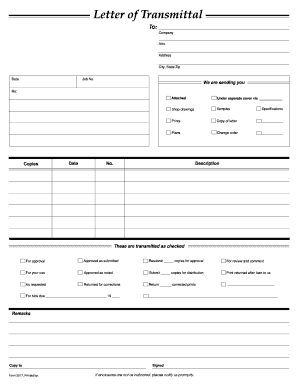

How Do I Complete Form 1096?

- First, enter the name of your business (as the 'FILER')and address; a name of a person to contact, and an email address, phone number, and fax number.

- Enter your Employer ID Number (EIN) (Box 1) or Social Security Number (Box 2), if you don't have an EIN.

- In Box 3, enter the total number of forms you are submitting with this 1096.

- In Box 4, enter the total federal income tax withheld on all the forms you are submitting. If you didn't withhold any federal income tax, indicate '0'.

- In Box 5, enter the total amount of reported payments on all the forms you are submitting. (That is, all of the amounts on all of the 1099 forms.)

- In Box 6, enter an 'X' in the box for the type of form you are submitting. For example, if you are submitting 1099-MISC forms, enter an X in the 1099-MISC box.

Other Instructions for Form 1096

- Be sure that all the information on the 1096 form about you (the FILER), including your EIN, is the same as on the 1099-MISC forms you are submitting.

- Don't forget to sign and date the form.

Free Irs Form 1096 Template

Back to Filing Year End Wage and Tax Reports

Free Fillable 1096 Form 2017

- Six Important Things to Know

- Filing Form 1096 Electronically

- Where Can I Get 1096 Forms?

- Other Instructions for Form 1096